Hauser’s law: you can’t soak the rich

16-Jun-08

Via Wall Street Journal article: You can’t soak the rich. by David Ranson, May 20, 2008.

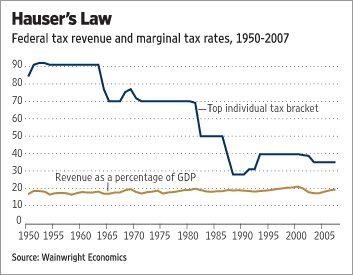

“…Mr. Hauser uncovered the means to answer these questions definitively. On this page in 1993, he stated that “No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP.” What a pity that his discovery has not been more widely disseminated.

The chart [above], updating the evidence to 2007, confirms Hauser’s Law. The federal tax “yield” (revenues divided by GDP) has remained close to 19.5%, even as the top tax bracket was brought down from 91% to the present 35%. This is what scientists call an “independence theorem,” and it cuts the Gordian Knot of tax policy debate.

The data show that the tax yield has been independent of marginal tax rates over this period, but tax revenue is directly proportional to GDP. So if we want to increase tax revenue, we need to increase GDP.

…

What happens if we instead raise tax rates? Economists of all persuasions accept that a tax rate hike will reduce GDP, in which case Hauser’s Law says it will also lower tax revenue.

…

What makes Hauser’s Law work? For supply-siders there is no mystery. As Mr. Hauser said: “Raising taxes encourages taxpayers to shift, hide and underreport income. . . . Higher taxes reduce the incentives to work, produce, invest and save, thereby dampening overall economic activity and job creation.”Putting it a different way, capital migrates away from regimes in which it is treated harshly, and toward regimes in which it is free to be invested profitably and safely. In this regard, the capital controlled by our richest citizens is especially tax-intolerant.”