Bush left office with a budget deficit of $482 billion, the largest ever in nominal dollars (although not the largest as a percentage of GDP).

Bush was roundly criticized (deservedly so) for increasing the budge deficit. How often did you hear during the campaign that Bush “turned a budget surplus into a budget deficit”?

So what will the Obama administration do? Tighten some belts, scrimp and save? Reverse the policies that led to the deficit in the first place?

Hahahaha….no.

The Congressional Budget Office’s projected deficit for the 2009 fiscal year ending on Sept. 30 would amount to 13.1 percent of expected gross domestic product—a level not seen since World War Two. In January, the budget office had forecast a $1.2 trillion deficit for fiscal 2009.

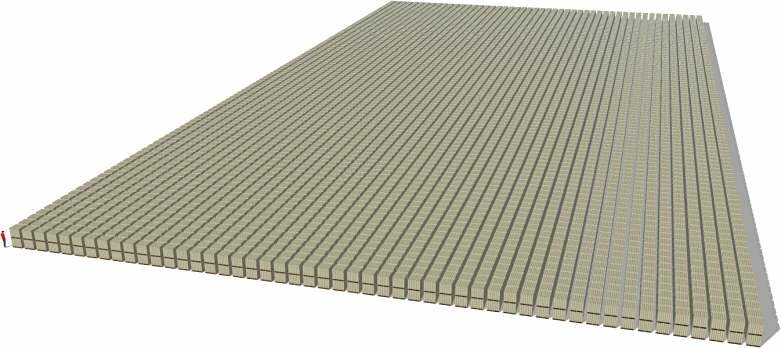

As a reminder, here’s what $1 trillion looks like:

Each of the individual cubes represents a pallet of $100 million dollars, enough to buy 4000 brand new Toyota Prius.

And they’re not done spending yet. The Obama administration has pledged

$12.8 Trillion for the financial bailout, almost equal to the entire GDP of the United States:

The U.S. government and the Federal Reserve have spent, lent or committed $12.8 trillion, an amount that approaches the value of everything produced in the country last year, to stem the longest recession since the 1930s.

The CBO estimates that the Obama administration will double the national debt over the next decade, from $4.4 trillion to $9.3 trillion.

Remember this Moveon.org ad?

It appears that the Obama administration interpreted it not as a cautionary tale, but as a blueprint for action.

Unfortunately, I don’t think we’ll see much true change until we change the institutional incentives that result in bad government. (Remember that McCain suspended his campaign to push for the first $750 billion bailout.)

Until then, prepare for heavy taxes, inflation, and social unrest.